Medicare Prescription Payment Plan

The Medicare Prescription Payment Plan may help you manage monthly drug costs

The Medicare Prescription Payment Plan is a payment option that may help you manage your covered Part D prescription drug costs. You can choose to spread out your covered Part D out-of-pocket prescription drug costs over the rest of the calendar year.

The Medicare Prescription Payment Plan doesn’t lower your covered Part D drug costs or save you money. It may be helpful if you want to spread the payment of your covered Part D drug costs across the remaining months of the year. Your out-of-pocket Part D drug costs will still be the same at the end of the plan year, with or without the program. The only difference is how you pay and the amount you pay each month.

How does the Medicare Prescription Payment Plan work?

If you opt in to the program, you'll no longer pay the pharmacy when you fill your covered Medicare Part D prescriptions. Instead, your plan will pay the pharmacy and send you a monthly bill. You’ll get a separate bill for your monthly plan premium if you have one.

How would my bills be calculated in the program?

Your bill can change each month, depending on when you opt in to the program and if you’ve already filled any prescriptions. Your first bill of the year will be calculated differently than the remaining months. It’ll be based on what you owe for your prescriptions divided by the number of months left in the year, until you reach the $2,100 out-of-pocket maximum.

Here are a couple examples of what your monthly bills could look like if you opt in to the program in 2026. Everyone’s situation is unique. Remember, you won’t pay more than $2,100 for Medicare Part D-covered drugs in 2026.

Example 1: If your first prescription of the year in January costs $2,100 or more, you’ll reach your annual out-of-pocket maximum for the year. That means you’ll pay $175 each month from January through December.

Example 2: If you fill a prescription for less than $2,100 in January or later, the first month’s bill calculation will take your annual out-of-pocket maximum of $2,100 and divide it by the remaining months of the year to give you the most you could pay that month. If your prescription costs are less than that amount, you’ll pay the full cost of your prescriptions the first month you’re in the program.

For the second month and later, any amount you owe will be billed to you in amounts that will be spread over the remaining months of the year. As you fill more prescriptions, your monthly payment may increase because there will be fewer months left in the year.

Once you have reached the $2,100 annual out-of-pocket maximum, you’ll no longer accumulate costs, but you’ll still owe your remaining monthly payments for the rest of the year. Any past due balances from previous months may also be included in your bill, making the total due more than the maximum monthly amount.

It’s important to remember:

- You won’t pay any interest or fees on the amount you owe, even if your payment is late

- All Medicare Part D prescription drug plans use the same formula to calculate your monthly payments under the Medicare Prescription Payment Plan

- Always pay your plan premium bill first

- Don’t include payment for your Medicare Advantage plan premium with your Medicare Prescription Payment Plan payment. Payments should always be sent separately.

Is the Medicare Prescription Payment Plan right for me?

It depends on your situation. If you decide to opt in to the program, it’s important to remember that your Medicare Prescription Payment Plan monthly bill may change and you’ll still need to pay your Part D deductible, if you have one.

![]()

Good fit

The program may be a good fit for you if:

- You fill several high-cost covered Part D drugs early in the year

- You’ll hit the $2,100 annual out-of-pocket maximum amount before September 2026

- You want to spread your covered Part D drug costs throughout the rest of the year

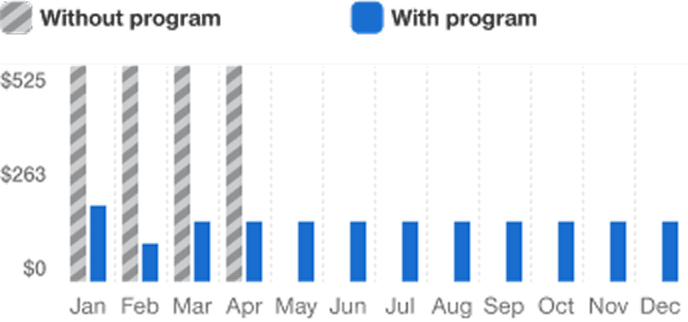

In this example from Medicare, rather than paying $525 out-of-pocket per month for the first 4 months of the year for a covered Part D drug, a program participant would pay about $190.38 per month over the course of the calendar year. This is only one example of how the program would work. Each person’s situation depends on their plan’s structure and their personal prescription needs.

Not a good fit

The Medicare Prescription Payment Plan may NOT be a good fit for you if:

- Your yearly covered Part D drug costs are low and/or about the same each month

- Part D drug payments you or others on your behalf make won’t hit the $2,100 annual out-of-pocket maximum in 2026

- You’re considering joining the payment program late in the calendar year (after September)

- You have a health reimbursement arrangement, health savings account or other secondary coverage

- You qualify for Extra Help or another government program to help save on your covered Part D prescription drug costs

- You don’t want to change how you pay for your drugs

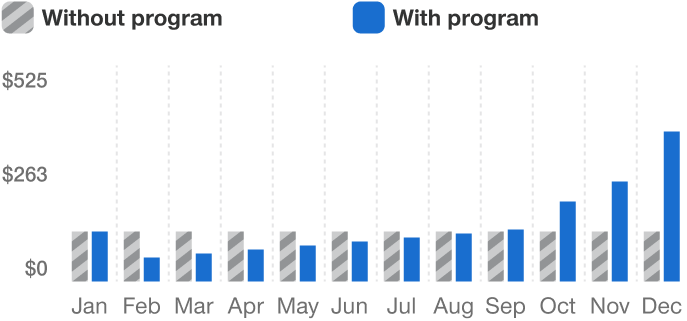

In this example, a person whose covered Part D prescription drugs always cost $55 out-of-pocket per month would not reach the $2,100 out-of-pocket maximum for the year. In this scenario, you would end up paying less at the beginning of the year but more at the end. Each member’s circumstances will differ.

Do I have to join the Medicare Prescription Payment Plan?

No. Participation in the Medicare Prescription Payment Plan is voluntary and may not be a good fit for everyone. Opting in to the program might make your out-of-pocket drug costs less predictable, with the largest bills possibly coming at the end of the year.

How do I opt in to the Medicare Prescription Payment Plan?

You can opt in to or out of the program at any time throughout the year. If you think this payment option is right for you, first enroll in any Medicare Advantage plan with prescription drug coverage. UnitedHealthcare members can then:

- Register or log in to the member site

- Call us at the toll-free number for members on your UCard

- Complete the Medicare Prescription Payment Plan Participation Request Form and mail it to the address on the form

- Enroll online: Medicare Prescription Payment Plan Participation Request Form

If your benefits are administered by your former employer, union group or trust administrator (plan sponsor), you can opt in to the program after you have enrolled in your Medicare Part D plan for the plan year.

For more information visit medicare.gov/prescription-payment-plan or call 1-800-633-4227, 24 hours a day, 7 days a week; TTY users can call 1-877-486-2048

Do I need to rejoin the program each year?

If you joined the Medicare Prescription Payment Plan, and are switching to a different UnitedHealthcare Medicare Advantage plan, you’ll need to opt in to the program again to continue for the next year. If you're staying in the same plan, your participation will continue from one calendar year to the next unless you decide to opt out.

How would I opt out of the program?

If you decide the Medicare Prescription Payment Plan is no longer a good fit for you, you can opt out at any time. You can:

- Log in to your member site

- Call us at the toll-free number for members on your UCard

If you opt out of the program, your Medicare drug coverage and other Medicare benefits won’t be affected, and you’ll go back to paying the pharmacy directly for all your covered out-of-pocket Part D drug costs.

You're still required to pay your outstanding balance if you decide to switch plans or insurance providers. You can pay the remaining balance in full or continue to pay your monthly bills through the end of the year. If your plan year ends in December, for example, you will receive a final bill in January.

If you don’t make your monthly payments, you will be removed from the program. You'll continue to receive monthly bills until your balance is paid in full. You can only rejoin the program after you pay your outstanding balance.

Are all my prescription drugs included in the program?

The Medicare Prescription Payment Plan applies to all your Medicare Part D-covered prescriptions. Medicare Part A and Part B drugs and bonus drugs are not eligible to be included in the program. Off-benefit drugs, paid for with a discount card or covered by a patient assistance program (PAP), are also not included.

What programs might help lower my drug costs?

You may qualify for one of the following programs to help reduce your prescription drug costs:

Extra Help: A Medicare program that helps you pay your drug costs if you have limited income and resources

Medicare Savings Program: A state-run program that helps people with limited income and resources pay some or all their Medicare premiums, deductibles and coinsurance. Visit medicare.gov/medicare-savings-programs to learn more.

State Pharmaceutical Assistance Program (SPAP): A program that may include coverage for your Medicare drug plan premiums and/or cost-sharing. SPAP contributions may count toward your Medicare drug coverage out-of-pocket limit. Visit go.medicare.gov/spap to learn more.

Manufacturer’s Pharmaceutical Assistance Programs (sometimes called Patient Assistance Programs (PAPs): A program from drug manufacturers to help lower drug costs for people with Medicare. Visit go.medicare.gov/pap to learn more.

Who can help me decide if I should opt in to the program?

How the Medicare Prescription Payment Plan works