Changing Medicare plans

When can I change Medicare coverage?

You can make changes to your Medicare coverage during a few key times.

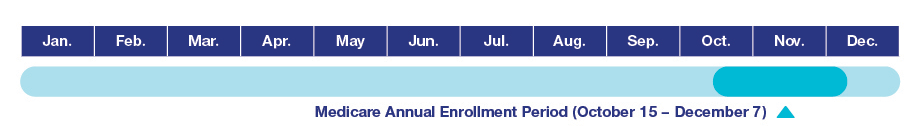

- The Medicare Annual Enrollment Period (AEP), October 15 to December 7

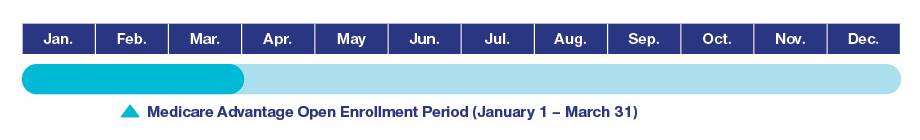

- The Medicare Advantage Open Enrollment Period (MA OEP), January 1 to March 31

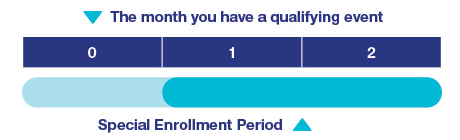

- The Medicare Special Enrollment Period (SEP) for qualifying life events; dates vary based on qualifying event

The Medicare Annual Enrollment Period

The Medicare Annual Enrollment Period (AEP) happens every year from October 15 to December 7. During this time, anyone with Medicare can make changes to their coverage for the following year.

What if I don’t want to change my Medicare coverage?

If you like your current Medicare coverage, you don’t need to do anything during AEP. Your current plan will automatically renew for the next year.

The Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period (MA OEP) is for current Medicare Advantage plan members. It runs from January 1 to March 31. During this time, Medicare Advantage plan members can revisit their plan choices and choose to make coverage changes.

You can do the following during the Medicare Advantage Open Enrollment Period:

- Switch to a different Medicare Advantage plan

- Drop your Medicare Advantage plan and go back to Original Medicare (Parts A and B)

- Enroll in a standalone Medicare prescription drug plan (Part D), if you go back to Original Medicare

And similar to the Medicare Annual Enrollment Period, if you choose to return to Original Medicare, you are now able to apply for a Medicare Supplement insurance plan, though you are not guaranteed coverage and could face higher costs. Please note that you can apply for a Medicare Supplement plan at any time during the year and aren't limited to the enrollment periods described above.*

Special Enrollment Period (SEP) – for Medicare Advantage or Part D members

Current Medicare enrollees may qualify for a unique 2-month Special Enrollment Period to switch to a different Medicare Advantage or Part D prescription drug plan due to a "qualifying life event."

You may qualify for a 2-month Special Enrollment Period in the following situations:

- You move out of your plan's service area

- Your plan closes, stops serving the area where you live, significantly reduces its provider network or your plan consistently receives low Medicare star ratings

- You want to enroll in a 5-star plan at any time or drop your first Medicare Advantage plan within 12 months of enrolling

- You move into or out of a qualified institutional facility, like a nursing home

- You are enrolled in or lose eligibility for a qualified State Pharmaceutical Assistance Program

- You have Medicare financial assistance such as Medicaid, a Medicare savings program or Extra Help, or you gain or lose eligibility for any of these

- You enroll in or leave the Program of All-Inclusive Care for Elderly (PACE)

- You gain or lose eligibility for a Special Needs plan

Some situations not listed here may qualify for a Special Enrollment Period as well. If you have questions about your personal situation, call your state health insurance assistance program for help.

What can I do during this time?

- Switch to a new Medicare Advantage or Part D plan

- Drop your Medicare Advantage plan and return to Original Medicare

If you return to Original Medicare, you can also enroll in a standalone Part D plan and/or apply for a Medicare Supplement insurance plan. Please note that you can apply for a Medicare Supplement plan at any time during the year and aren't limited to the enrollment periods described above. If you apply for a Medicare Supplement insurance plan outside of your Medigap Open Enrollment Period, which is the six-month period beginning with the first day of the month in which you are age 65 or older and enrolled in Medicare Part B, you may be subject to underwriting or pay a higher rate.*

You've got questions.

We've got answers.

Chat with UnitedHealthcare

Chat is currently unavailable.

Please try again later.

Find a plan

Meet with us

Make an appointment with a licensed insurance agent in your area.

Scroll for Important Disclosures

*Please note that you may be underwritten and not accepted into the plan if you are outside of Medicare Supplement Open Enrollment or Guaranteed Issue periods or, if accepted, your rate may be higher. This does not apply to residents of Connecticut and New York where Open Enrollment and Guaranteed Issue is ongoing and Medicare supplement plans are guaranteed available.

UnitedHealthcare pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers.

AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals.

Please note that each insurer has sole financial responsibility for its products.

AARP® Medicare Supplement Insurance Plans

AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare.

Insured by UnitedHealthcare Insurance Company, 185 Asylum Street, Hartford, CT 06103 (available in all states/territories except ND, NY) or UnitedHealthcare Insurance Company of America, 1600 McConnor Parkway, Floor 2, Schaumburg, IL 60173 (available in AR, AZ, IL, IN, MS, NC, ND, NJ, OH, PA, SC, TN) or UnitedHealthcare Insurance Company of New York, 2950 Expressway Drive South, Suite 240, Islandia, NY 11749 (for NY residents). Policy Form No. GRP 79171 GPS-1 (G-36000-4).

In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease.

Not connected with or endorsed by the U.S. Government or the federal Medicare program.

This is a solicitation of insurance. A licensed insurance agent/producer may contact you.

You must be an AARP member to enroll in an AARP Medicare Supplement Plan.

THESE PLANS HAVE ELIGIBILITY REQUIREMENTS, EXCLUSIONS AND LIMITATIONS. FOR COSTS AND COMPLETE DETAILS (INCLUDING OUTLINES OF COVERAGE), CALL A LICENSED INSURANCE AGENT/PRODUCER AT THE TOLL-FREE NUMBER ABOVE.

Medicare Advantage plans and Medicare Prescription Drug plans

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract and a Medicare-approved Part D sponsor. Enrollment in these plans depends on the plan's contract renewal with Medicare. You do not need to be an AARP member to enroll in a Medicare Advantage plan or Medicare Prescription Drug plan.

This information is not a complete description of benefits. Contact the plan for more information.

WB27547ST